The post 50% of Fed Policymakers Expect Two Extra Interest Rate Cuts by End-2025 appeared first on Coinpedia Fintech News

Today’s all eyes are on the Fed Chair Jerome Powell who will speak today at 8:30 a.m. EST. Meanwhile crypto traders are watching closely for hints about future rate cuts.

As recent Fed minutes show that 50% of the policymakers expect two more cuts by the end of 2025, a sign of a possible policy shift that could boost the next crypto rally.

Fed Split Over Forward Rate Cuts

For the first time Fed reduced interest rates by 25 basis points last month, lowering the federal funds rate to a range of 4.00% to 4.25%, committee remains split on the pace and extent of further easing.

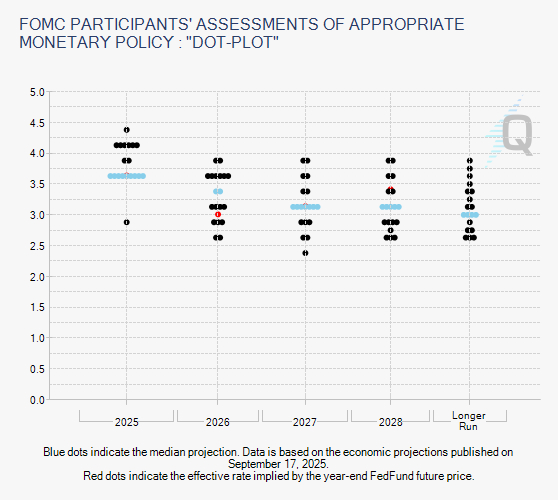

The September FOMC “dot plot” shows a clear split. 50% of the policymakers expect two small rate cuts to bring interest rates closer to normal. The others remain cautious, worried that inflation could return if Trump’s tariff plans push prices higher.

Right now, rates sit between 4.00% and 4.25%, with markets already pricing in cuts for October and December. That means investors aren’t entirely surprised, but the official confirmation of dovish leaning still matters.

On top of it Coinpedia news reported that Governors, Stephen Miran advocated for a more aggressive 50bps (0.50%) cut, citing softening job market data and underlying inflation nearing the Fed’s 2% target

Shutdown and Labor Market Concerns

Adding to the Fed’s tilt is the ongoing government shutdown, which started on October 1, 2025 has completely sidelined nearly 750,000 workers daily and disrupting economic data reporting.

This “data vacuum” creates uncertainty about the real strength of the labor market and overall economy, making it harder for the Fed to make confident decisions.

Why This Matters for Crypto

Low rates typically weaken the U.S. dollar and push investors toward higher-yielding assets. In past cycles, Bitcoin and Ethereum have benefitted from similar outcomes, with BTC gaining over 5% in short windows when rate cuts were expected.

As of now, Bitcoin is trading around $123, slightly up in the last 24 hours, while Ethereum, currently hovering around $4383 it continues to attract institutional interest.

4 hours ago

501

4 hours ago

501

English (US)

English (US)