As the broader cryptocurrency market experiences massive capital outflows, a whale has suffered a costly misstep, dumping thousands of Ethereum (ETH) at a steep loss after attempting to time the market bottom.

The wallet identified as ‘0x1b57’ offloaded 5,570 ETH, approximately $19.56 million, over several hours, sending the funds to Binance in three large batches: 2,070 ETH ($7.26M), 2,000 ETH ($7.01M), and 1,500 ETH ($5.28M), according to the latest on-chain data obtained by Finbold from Arkham on November 4.

Crypto whale ETH transactions. Source: Arkham

Crypto whale ETH transactions. Source: ArkhamThe trader had accumulated the same amount of ETH just five days earlier from Binance hot wallets but quickly capitulated as prices continued to slide, realizing an estimated $2.15 million loss. Despite attempting to “catch the bottom,” the trader was forced to exit as selling pressure intensified.

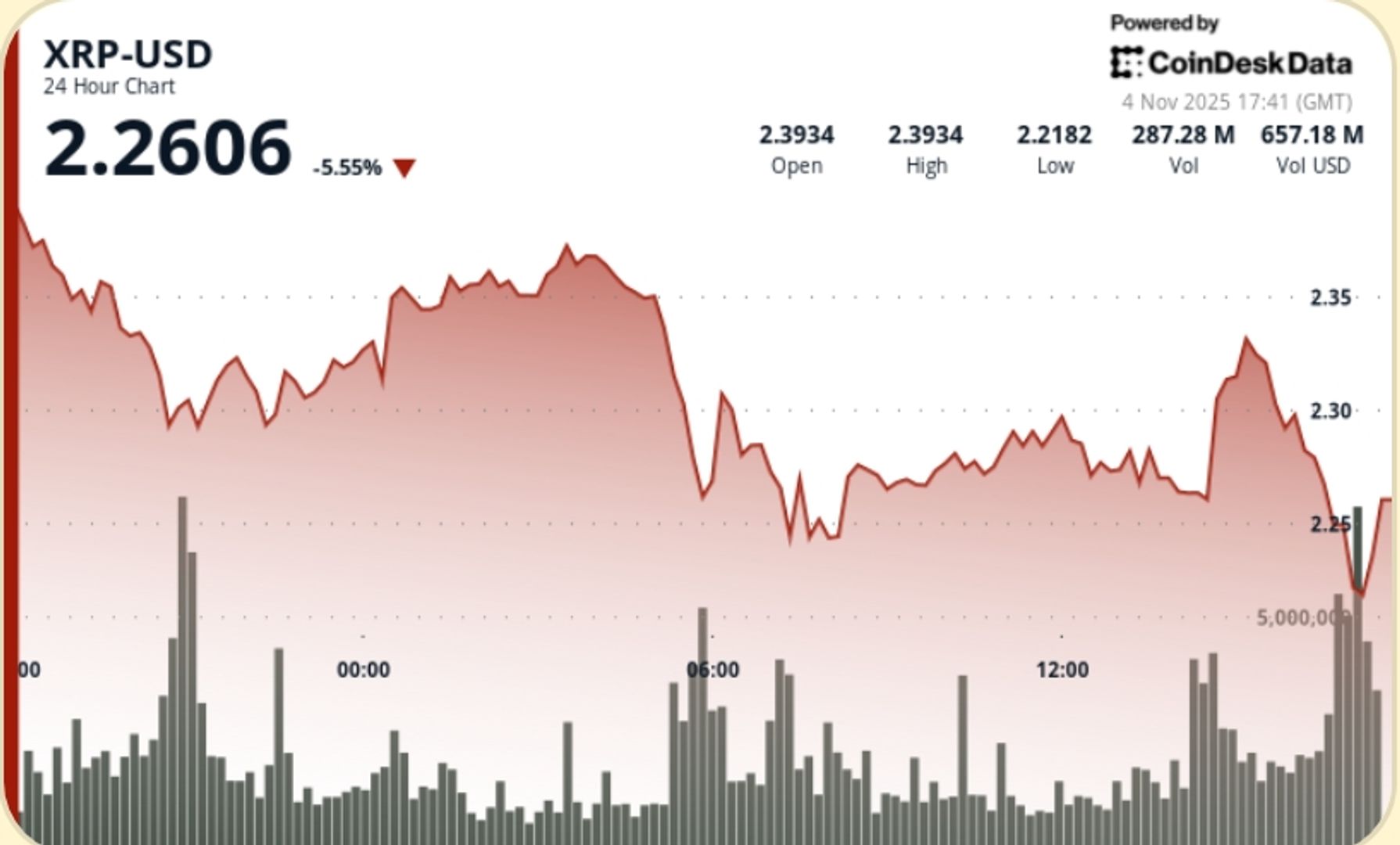

The sell-off aligns with broader crypto market weakness, with Ethereum recently extending declines amid risk-off sentiment across digital assets.

Indeed, whale activity can potentially exacerbate downward pressure on Ethereum’s price, as large holders tend to spook markets when they sell.

Ethereum price analysis

Meanwhile, Ethereum has been among the biggest losers in the past week, with the second-ranked cryptocurrency plunging over 15%, trading at $3,508 as of press time, a decline of more than 5% in the past 24 hours.

ETH seven-day price analysis. Source: Finbold

ETH seven-day price analysis. Source: FinboldAt the current valuation, Ethereum is firmly below its 50-day SMA of $4,094.6, signaling a loss of short-term support and confirming bearish momentum.

The 200-day SMA at $3,316.08 now acts as the next critical floor; holding above it would keep the long-term uptrend intact, while a break below could indicate a deeper correction.

Meanwhile, the 14-day RSI sits at a neutral 36.72. While not yet oversold, it leaves room for further downside before buyers typically step in, though it is low enough to warn that selling exhaustion could occur if volatility spikes.

Featured image via Shutterstock

The post Crypto trader loses over $2 million in 5 days as market tanks appeared first on Finbold.

4 hours ago

389

4 hours ago

389

English (US)

English (US)