The post Dogecoin Whales Offload Billions in DOGE—Is the DOGE Price Rally at Risk of Plunging to $0.1? appeared first on Coinpedia Fintech News

The crypto market conditions are deteriorating, with over $250 billion lost in the past 24 hours and nearly $100 billion in the past few hours. Bitcoin price slipped below $104,500 and is believed to be heading towards the crucial support at $102,436. The altcoins are also badly hit, with most of them following the star token. In the meantime, the Dogecoin price has not only followed the trend but has also broken one of the most crucial bullish patterns. With only a couple of support ranges currently present above $1, the question arises whether Dogecoin bulls will be able to hold the rally above the range.

Whale Distribution Grows as DOGE Price Slips Toward Key Support Levels

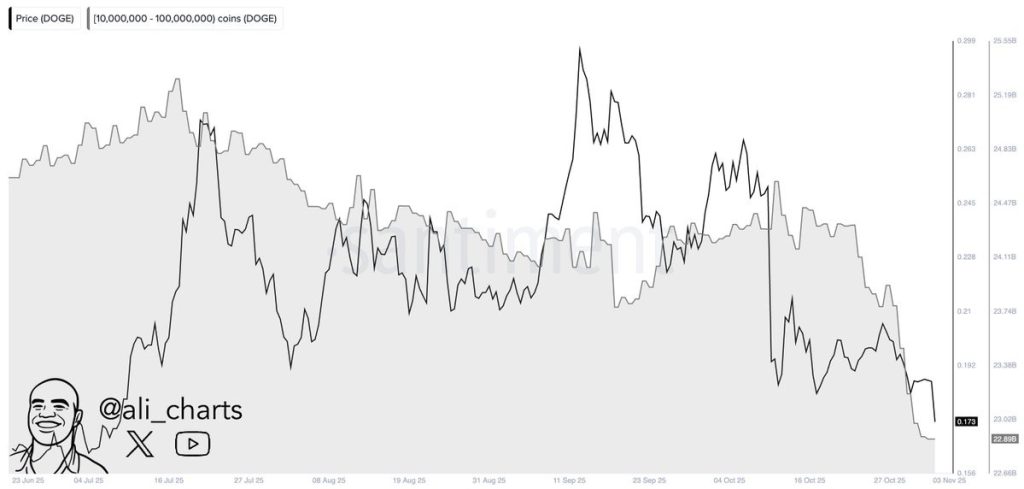

Dogecoin’s price has been under visible pressure as large wallet holders continue reducing their exposure. The recent decline below $0.18 mirrors the broader market downturn, with whale activity suggesting strategic profit-taking or risk management ahead of key market events. As DOGE faces tightening liquidity and reduced accumulation, investor sentiment appears cautious, raising questions about the sustainability of any near-term recovery.

The Santiment chart shared by analyst Ali shows Dogecoin’s price falling alongside a steady decline in holdings from addresses containing 10 million to 100 million DOGE. This trend highlights consistent whale distribution over the past few months, which has intensified since mid-October. Such selling pressure typically signals weakening confidence among large holders and can amplify volatility in the short term. Unless accumulation resumes, DOGE may continue facing downside risk before any significant price rebound occurs.

Dogecoin Price Analysis: Is DOGE Heading to $0.1?

Dogecoin has broken a crucial support line, which has been acting as a strong base since the start of 2024. During the recent meltdown, the price broke this range, but the buyers quickly jumped in and prevented an extended loss. However, the current scenario suggests a major drop in the buyers, which has now activated the lower support range around $0.12 and below $0.1.

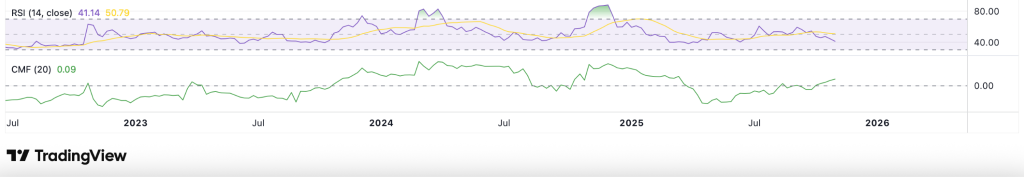

As seen in the above chart, the price is heading towards the pivotal support at the 200-day weekly EMA at $0.156. The historical chart shows whenever the token has broken below the range, it has remained consolidated for a pretty long time until the bulls trigger a strong breakout with a massive increase in the buying pressure. On the other hand, the RSI & CMF are deviating while the MACD remains bearish.

The RSI is below 50, hinting at the weakening of buying strength, while the CMF flattening near zero indicates liquidity is drying up. This combination often precedes a consolidation period or minor correction before a new trend forms. This divergence implies the smart money accumulation by the institutions or large traders, which may further help the price rebound once the selling pressure fades.

For Dogecoin to regain upside traction, RSI needs to climb above 50 with CMF turning sharply positive—confirming renewed whale and retail inflows.

Conclusion: Is Dogecoin Heading Toward $0.10?

Dogecoin continues to face mounting sell pressure as large holders reduce exposure, and market sentiment remains fragile. Throughout November, the meme coin has struggled to reclaim momentum above $0.17, suggesting traders are cautious amid a broader crypto cooldown. A drop toward $0.10 is possible if selling accelerates, particularly if Bitcoin and other majors fail to recover from current lows.

However, Dogecoin’s community-driven nature and historical resilience during downturns may help cushion deeper losses. If market conditions stabilize and renewed retail interest emerges, DOGE could attempt a short-term rebound toward the $0.18 mark.

In conclusion, while a retest of $0.10 cannot be ruled out, Dogecoin is more likely to hover between $0.14 and $0.18 in the coming weeks as traders wait for clearer directional cues.

5 hours ago

1088

5 hours ago

1088

English (US)

English (US)