The speculative fever gripping Wall Street over the last seven months is finally wearing off. No, the market didn’t collapse this week, but for anyone chasing AI stocks, leveraged ETFs, or crypto trades, it sure as hell felt like the floor gave out.

Overhyped trades got dragged, overleveraged bets got vaporized, and Wall Street’s favorite buzzwords, AI and crypto, aren’t paying like they used to.

This week, tech stocks suffered their worst losses since April. Heavy hitters like Palantir and Oracle both took hits, dragging down the high-risk playgrounds that retail and institutional investors had been partying in, like meme stocks and quantum-leveraged ETFs.

Bitcoin, which had recently been rallying nonstop, slid sharply again toward the $100,000 line as major buyers vanished. That came after weeks of aggressive liquidation that left a crater in crypto markets. Confidence? Wrecked.

AI trades pull back as reality hits

This isn’t about one bad day. It’s a crack across the whole “risk-on” system. Wall Street pros had already been warning that AI valuations were getting ridiculous. That warning just became a flashing red signal. Palantir, one of the loudest AI names, fell 8% even after solid earnings.

Why? Because its price-to-earnings ratio is in the hundreds. According to Peter Atwater, a behavioral economics professor at William & Mary, “It sits in the same neighborhood as AI, as crypto… These are all crowd favorites. So this is a crowd phenomenon.”

He’s not wrong. The signs are everywhere. A Meta-linked ETF sank 8.5% this week. A Palantir-heavy product tanked 22%.

A Strategy Inc.-style ETF dropped over 20%. Trades linked to Super Micro Computer and quantum computing? Also broke down. The once-inseparable trades that moved in sync are now ripping apart.

The Magnificent Seven, the elite group of tech stocks, slid 3% as questions surfaced about their AI infrastructure spending. One unsettling note came from OpenAI’s CFO, who said the U.S. government might have to “backstop” AI funding.

That line alone rattled a lot of risk takers. Atwater added, “There’s been a decided negative bias to what people are saying about AI… scrutiny should intensify.”

Crypto cracks harder than tech

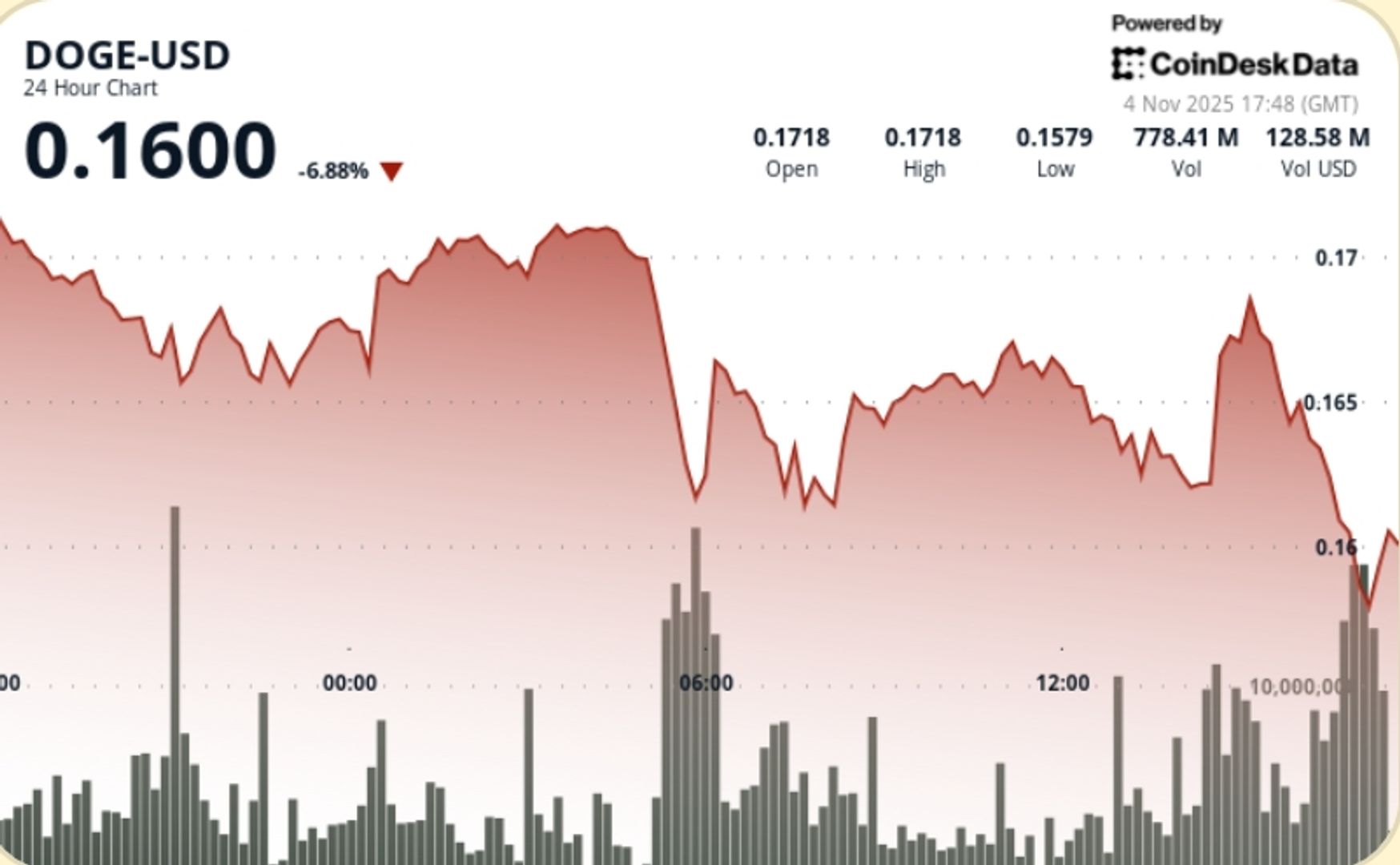

But nowhere is the pain more obvious than in crypto. Over the last week, over $700 million fled crypto ETFs.BlackRock’s Bitcoin ETF alone lost nearly $600 million. Its Ether ETF shed another $370 million. Solana and Dogecoin products are both down double digits.

The brand-new MEME ETF, designed to track retail sentiment, is already down 20% just a month after launch. Even the air around meme stocks, new IPOs, and unprofitable tech names is thinning, some ETFs in that space dropped 5–7% this week alone.

Stephen Kolano, CIO at Integrated Partners, said it bluntly: “Profit taking is coming from the things that have run the most since early April, which is AI and anything connected with it, which explains the pressure in crypto.”

And it’s not just about sentiment. The crypto dump is bleeding into retail risk overall. Robinhood’s boom, tokenized assets, prediction markets, all of that was helping keep Wall Street’s 2025 rally going, even with labor issues and tariff noise. But now, with losing trades piling up and capital exiting the riskiest corners, there’s less fuel. Liquidity’s drying up where it matters most.

Still, this isn’t a full-blown collapse. The S&P 500 is down just 2% from its recent peak. But the crowd that got used to “everything goes up” is now learning the hard way; timing matters again. And leverage? It cuts both ways.

The deeper concern? Bitcoin’s 15% drop over the last month isn’t just about price. Analysts on Wall Street now see it as a signal for broader tech pain. One of the biggest red flags comes from Citi, which reported that the number of “whales,” large long-term holders, is shrinking. These whales usually hold during chaos. Not this time.

“Bitcoin has a knack for sniffing out things ahead of time,” said Eric Balchunas from Bloomberg Intelligence. “It’s always trading, so there’s a lot of chances for it to be a price-discovery vehicle. It’s open all the time, like a 7-Eleven.”

And this reversal stings more because it came just as crypto had momentum. The earlier 2025 surge was boosted by Trump’s plan to turn the U.S. into a crypto hub.

But since October, the total crypto market cap has lost almost 20%, cutting out most of the year’s gains. For those who believed regulatory clarity would bring in the next bull run, the speed of this crash has been brutal.

“There’s simply not enough new capital to offset locals exiting,” wrote Ilan Solot from Marex. “Too many in the industry just can’t stomach another crypto cycle — they’ve had enough, both financially and emotionally… For the uptrend to resume, the whales need to stop selling. Stabilizing ETF flows would help too.”

Join Bybit now and claim a $50 bonus in minutes

English (US)

English (US)