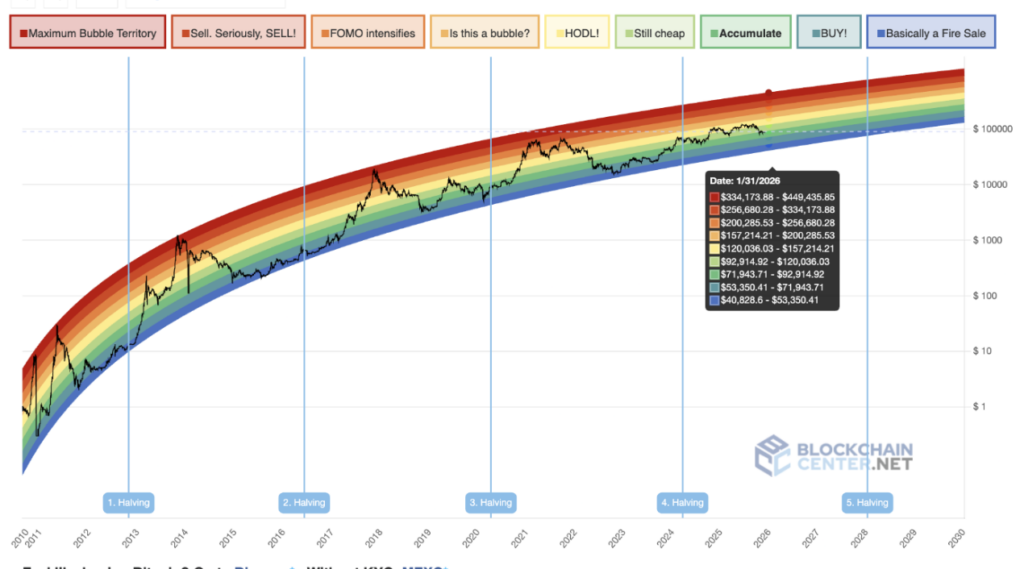

The cryptocurrency landscape witnesses a significant uptrend as Bitcoin breaches the $94,000 mark in an election year, invigorating interest after a long bearish stretch. Despite a notable leap, sustained growth hinges on increasing trade volumes and dynamic altcoin activities. As January progresses, a peak date of interest is the sixth.

What Changes Are Brewing in Crypto Regulations?

A strategic gathering is set to take place involving senators from both parties on January 6th, with discussions revolving around a new regulatory approach to digital currencies. Dubbed the CLARITY Act, this proposed legislation aims to provide transparent oversight of the cryptocurrency marketplace, addressing the industry’s evolving demands.

Emerging from last year’s approved GENIUS legislation, the focus shifts towards enabling banks and financial giants to delve deeper into stablecoin markets. The CLARITY Act seeks to build on this momentum by assisting large financial institutions in offering comprehensive cryptocurrency solutions.

Will a Fresh Perspective Propel Bitcoin Further?

While crypto providers exist, the imperative for the CLARITY Act’s swift passage grows. It is poised to unlock substantial incentives for banks, potentially infusing the cryptocurrency markets with newfound liquidity and driving asset appreciation.

Upon clearing the Senate, the legislative process moves to the House for further refinement, with a targeted time frame for presenting the bill to Trump by August this year.

Democrats, facing potential electoral setbacks due to their stance on cryptocurrency, have a pivotal chance to align with the millions invested in digital assets. If they expedite the bill alongside cooperative Republicans, the legislation could reach Trump’s desk by 2026.

With midterm elections posing a challenge, Trump’s strategy to win the electorate includes controlling inflation and interest rates while pushing decisive crypto legislation. His family’s involvement in crypto investments adds a layer of intrigue to Republican strategies.

“For our team, the passage of the CLARITY Act can bolster the U.S.’s leadership in global crypto innovations,” stated a prominent financial analyst.

Key takeaways include:

- Bitcoin’s soaring price projection remains conditional on regulatory clarity and increased trading activity.

- The CLARITY Act reflects bipartisan effort to regulate crypto markets, impacting institutional involvement.

- Democrats face a strategic opportunity by aligning legislation with crypto interests before midterm elections.

The dynamics of cryptocurrency legislation, coupled with political undercurrents, set the stage for potentially transformative shifts in both the crypto domain and the political arena. With significant stakes on the line, all eyes turn to forthcoming political maneuvers and their ripple effects on the market.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

English (US)

English (US)