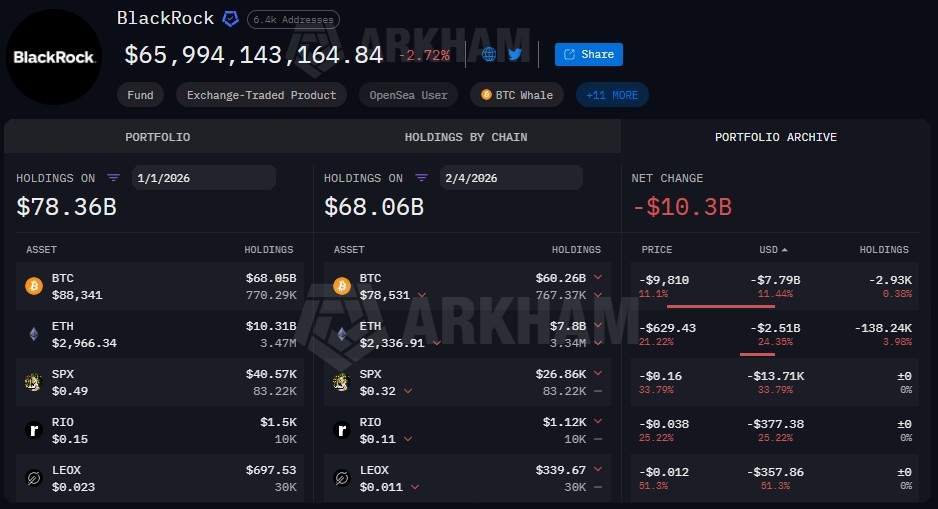

BlackRock, a leading investment company and the world’s largest asset manager, has moved$10.3 billion worth of cryptocurrencies since the beginning of 2026.

Specifically, the firm’s net digital asset exposure has dropped from $78.36 billion on January 1 to $68.06 billion at press time, February 4, according to real-time wallet tracking data Finbold obtained from Arkham.

Bitcoin (BTC) and Ethereum (ETH) accounted for the vast majority of the outflows, or $7.79 billion and $2.51 billion, respectively, while the rest was spread among minor tokens, such as SPX.

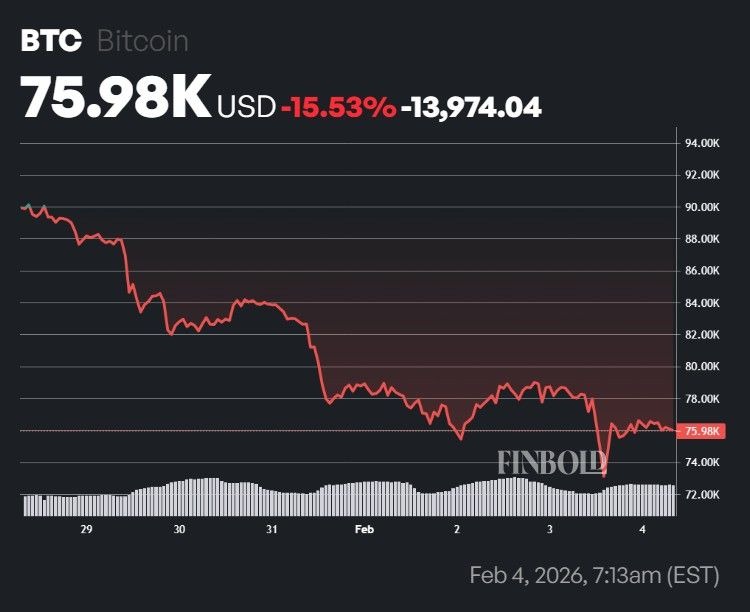

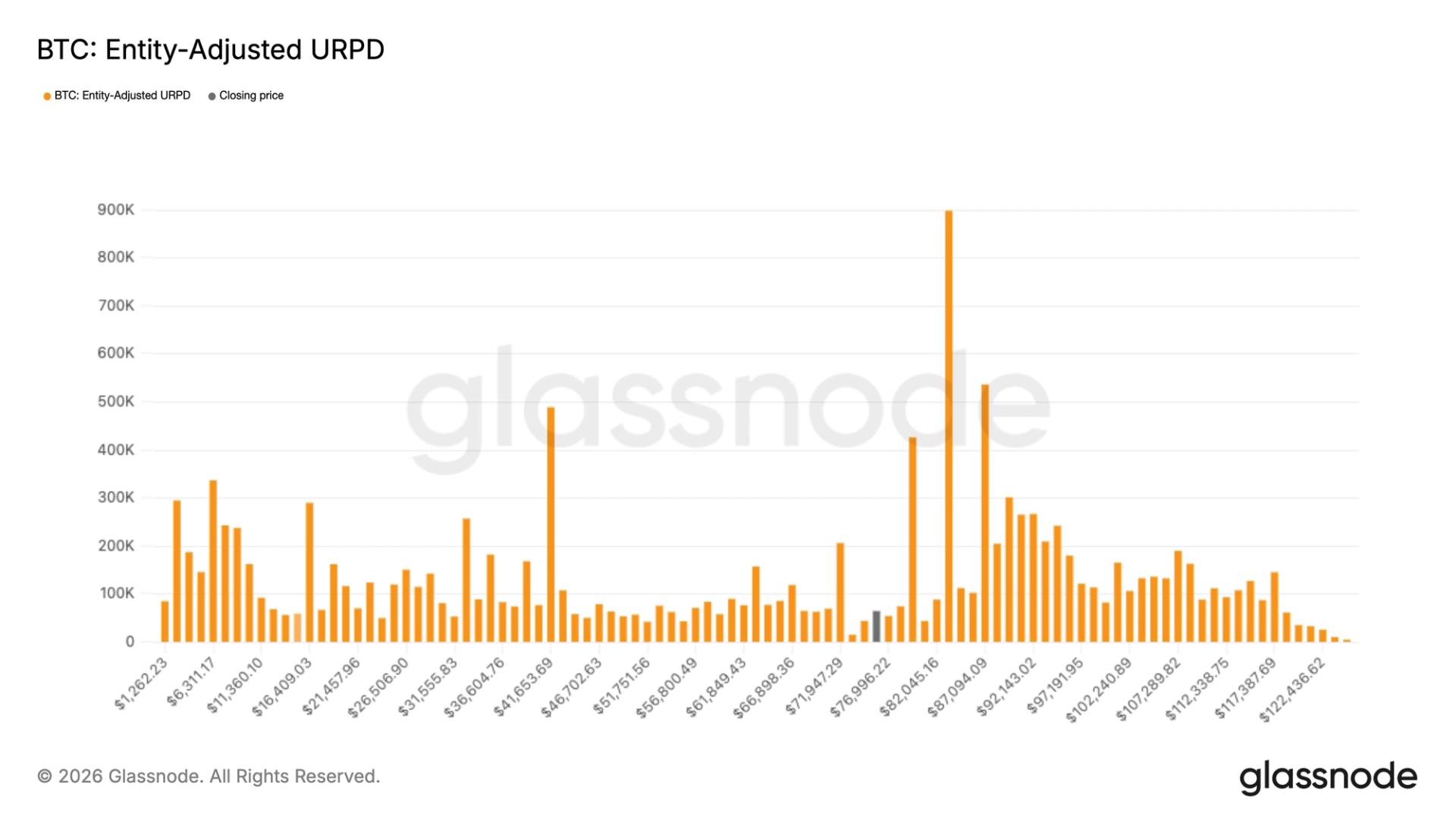

It must be mentioned, however, that asset prices have also dropped exponentially over the same period. For instance, BTC has declined 11.1% while Ethereum is down 21.22%. In other words, the negative net change is largely intertwined with the ongoing slump in the crypto market and does not necessarily represent sales per se, although holdings themselves did dropp (-2,930 bitcoin and -138,240 ETH).

BlackRock crypto holdings. Source: Arkham

BlackRock crypto holdings. Source: ArkhamFor comparison, over the same period last year, BlackRock added $5.16 billion to its holdings, nearly all of it in Bitcoin, whose price had gone up just over 5% in January 2025.

BlackRock’s most recent crypto losses

The fund has reported some noteworthy redemptions over the past few days. For instance, it shed 6,306 BTC, worth around $496.41 million, and 58,327 ETH, worth about $138.23 million, on February 2.

This meant that BlackRock alone was responsible for 78% of the total daily U.S. Bitcoin spot ETF outflows and more than 53% of the overall Ethereum redemptions that day.

On February 3, the situation was somewhat better. Namely, BlackRock’s Bitcoin holdings were $775 million in the green, while its Ethereum exposure went up by roughly $100 million.

Featured image via Shutterstock

The post BlackRock has dumped over $10 billion worth of crypto since the start of 2026 appeared first on Finbold.

2 hours ago

122

2 hours ago

122

English (US)

English (US)