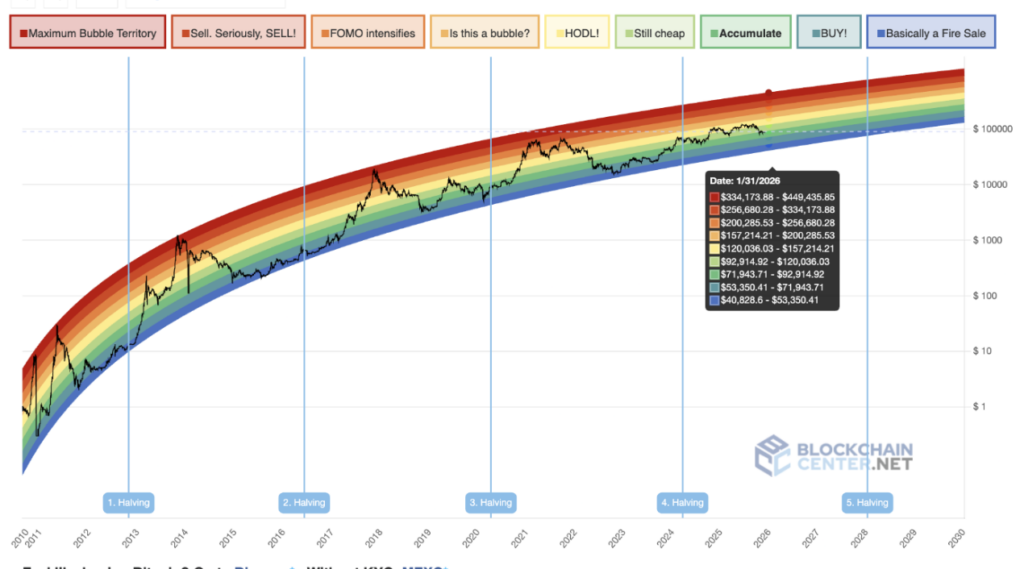

As 2026 unfolded, the Bitcoin derivatives market demonstrated a rising wave of optimism among traders. The dawn of the new year was marked by aggressive positioning in options, fueled by hopes of the cryptocurrency hitting six-figure price points. One area of notable interest was the focus on call options featuring a $100,000 strike price, slated to expire in January. This emphasis underscores pivotal short-term market dynamics, as professional investors gear up for potential bullish movements, indicated by increased open positions and funding rates.

Intensifying Interest Piqued by the $100,000 Benchmark

The first week of 2026 saw Deribit, the globe’s leading cryptocurrency options exchange, experience a surge in trading activities. The spotlight was firmly on $100,000 strike call options due to expire in January, reflecting trader expectations that Bitcoin could exceed this mark. These call options give their holders the right to buy assets at an agreed-upon price before the expiration date.

Jasper De Maere, a representative from Wintermute and an OTC strategist, observed significant trading activity aimed at repositioning and rolling over. He remarked,

“The fervor around the $100,000 options expiring on January 30, 2026, is particularly noteworthy.”

Can Derivatives Data Foreshadow Further Growth?

Yes, the clustering of positions suggests that the optimism seen in 2025 is spilling over into the new year. Previously, traders favored call options with higher strike prices, speculating on Bitcoin’s long-term ascent. Data from Deribit indicates an astonishing $1.45 billion in nominal open interest for the $100,000 strike options, with a significant $828 million associated with January expirations alone.

Experts assert that surpassing the $94,000 mark could quicken this trend. QCP Capital, based in Singapore, highlighted that Bitcoin perpetual futures funding rates exceeded 30%, which could prompt market makers to hedge more as prices ascend.

In the year’s initial days, Bitcoin’s value climbed nearly 5%, momentarily surpassing $93,000. Observers agree that crossing the $94,000 threshold could amplify momentum in derivatives positioning.

– The Bitcoin options market witnessed a surge, particularly around the $100,000 strike, suggesting continued trader optimism.

– Deribit noted $1.45 billion in nominal open interest for these options, with $828 million tied to January, indicating heightened focus on early-year market movements.

– A significant rise in perpetual futures funding rates reflects a readiness among market participants to hedge as spot prices rise.

A strong start for Bitcoin’s market in 2026 sets a speculative stage, fueled by fervent activity in derivatives, especially in options with a $100,000 strike price. This optimism highlights potential volatility as traders prepare for what they hope will be a substantial upward trend in cryptocurrency prices.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

English (US)

English (US)