The post Dogecoin & Cardano Price Predictions for 2026: Why New ATH Could be Tough for These Cryptos appeared first on Coinpedia Fintech News

The crypto sentiments are improving since the start of the year, with frequent bullish pushes and a significant rise in volume. Meanwhile, Dogecoin (DOGE) and Cardano (ADA) seem to remain away from the market dynamics. Despite small day-to-day swings, both tokens remain more than 80% away from their ATH, which makes a fresh high in 2026 a much higher bar than it looks. The question arises as to what is holding DOGE & ADA prices back?

DOGE Price Prediction 2026: Why the ATH Path Looks Unclear

Dogecoin (DOGE) remains one of the most watched meme coins, but its rallies are still largely driven by sentiment and liquidity, not steady fundamentals. That makes the DOGE price vulnerable to quick spikes and fast pullbacks, especially when the broader crypto market is not in full risk-on mode. With DOGE still far below its peak, the path to a Dogecoin all-time high (ATH) in 2026 likely requires sustained capital rotation and persistent spot demand.

Key reasons Dogecoin may struggle to reach a new ATH in 2026

- DOGE rallies often fade without follow-through: Dogecoin can surge on hype, but it typically needs multiple days of strong buying to convert a pump into a trend. Without that, price action stays choppy and range-bound.

- Liquidity tends to flow to Bitcoin and Ethereum first: In most cycles, capital concentrates in BTC and ETH before it spreads into high-beta assets like DOGE. If rotation stays narrow, Dogecoin can underperform even during bullish market phases.

- Ongoing supply adds pressure over time: DOGE has continuous issuance. That does not prevent rallies, but it raises the demand requirement. For DOGE to reclaim ATH, buyers need to absorb supply consistently—not just during short-lived bursts.

- Overhead resistance remains heavy after deep drawdowns: When a coin is far below its ATH, prior supply zones become sell areas. Many traders who bought higher tend to exit into rallies, which can cap upside.

- Meme competition is fragmented: The meme trade is no longer “one coin dominates.” Attention and liquidity are spread across many meme tokens, so DOGE needs a stronger catalyst to lead again.

What needs to change for DOGE to target ATH levels in 2026

Dogecoin’s breakout odds improve if these signals show up together:

- DOGE/BTC has been trending higher for weeks, which may return the relative strength

- Increase in Spot-led demand, which could expand the volume, helping price to hold gains

- Weekly structure flips bullish by forming higher highs and higher lows with shallow pullbacks

- Lastly, a broader risk-on meme cycle emerges across crypto markets

Dogecoin can still rally hard, but a new ATH in 2026 likely requires a full meme-risk cycle plus consistent liquidity, not occasional bullish pushes.

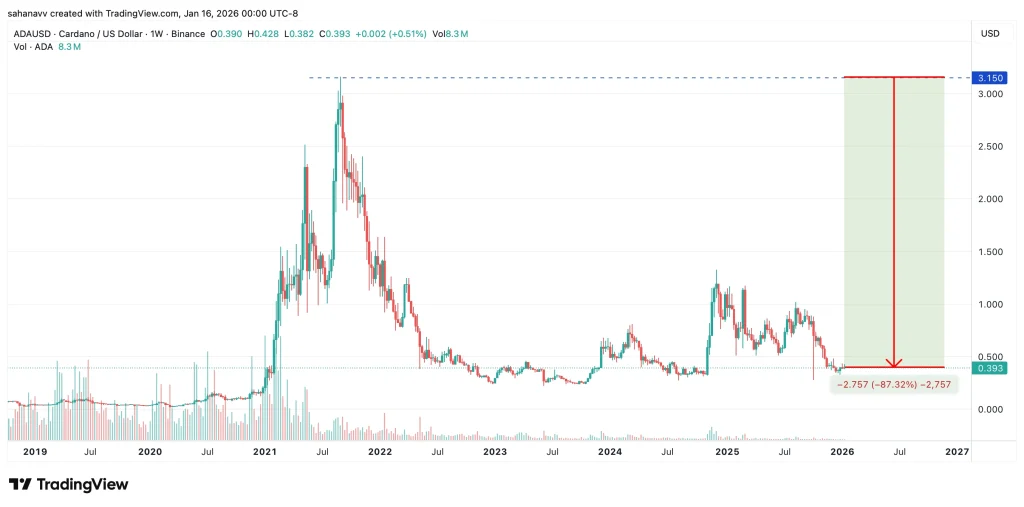

Cardano Price Prediction 2026: What ADA Must Improve to Reach ATH

Cardano (ADA) is a top crypto by market recognition, but price performance tends to depend on adoption and network demand. ADA price can move during broad market rallies, yet an ATH-grade run typically needs more than a bounce, as it needs improving fundamentals that show up in data. With ADA still far from its peak, the Cardano ATH in 2026 becomes a tougher target unless the ecosystem and relative strength meaningfully improve.

Key reasons Cardano may struggle to reach a new ATH in 2026

- ADA must outperform BTC to make an ATH run realistic: If ADA/BTC is weak, ADA usually lags on bigger cycle moves. A new ATH often requires sustained relative strength, not just a short rally.

- Ecosystem growth must show up in metrics: Traders watch TVL, DEX volumes, stablecoin activity, active addresses, and transaction growth. If these stay flat, ADA rallies can lack depth and durability.

- Competition for capital is intense: The market has many L1S and L2S competing for users, developers, and liquidity. If the “smart contract platform” narrative stays crowded, ADA needs a clearer edge or a standout catalyst.

- Overhead supply is thick after large drawdowns: Long-term resistance zones tend to attract sellers. Many holders use rebounds to reduce exposure, which can slow trend continuation.

- Catalysts can take time to translate into price: Even when upgrades or announcements hit, markets often wait for adoption proof before repricing ADA aggressively.

What needs to change for ADA to target ATH levels in 2026

Cardano’s odds improve if these conditions line up:

- ADA/BTC reverses into an uptrend, forming weeks of higher highs

- On-chain usage trends higher with TVL, and volumes expand consistently

- Weekly breakout holds with volume, not a one-day spike

- Capital rotates from BTC/ETH into large-cap altcoins in a sustained way

ADA price can still participate in bull phases, but a new ATH in 2026 likely needs measurable ecosystem acceleration plus strong relative performance versus Bitcoin.

Here’s What May Invalidate the Bearish Thesis

Even if DOGE and ADA look unlikely to reclaim ATH levels right now, this thesis flips quickly if the market delivers sustained demand signals instead of short-lived pumps. A clear invalidation would be both coins reclaiming major weekly resistance and holding it with rising spot volume, alongside a multi-week improvement in relative strength versus Bitcoin (DOGE/BTC and ADA/BTC in higher highs).

For Dogecoin, a renewed meme cycle led by spot-driven inflows and strong social dominance would be a major bullish trigger. Besides, the rise in TVL or DEX volumes or expanding stablecoin activity may invalidate the bearish trajectory for Cardano. In short, if DOGE and ADA start outperforming BTC for weeks and the data confirms real participation, both tokens may mark a new ATH in 2026.

4 hours ago

1763

4 hours ago

1763

English (US)

English (US)