The post FOMC Meeting Today: Why Jerome Powell Speech Matters More Than FED Rate Cut appeared first on Coinpedia Fintech News

The Federal Reserve will announce its interest rate decision today at 2:00 PM ET, followed by Chair Jerome Powell’s press conference at 2:30 PM ET. Markets widely expect a 25 basis point (bps) rate cut, with traders assigning nearly 85% probability to this outcome. Because of that, analysts believe the actual rate cut itself is unlikely to move markets in a major way.

Instead, attention is firmly on Powell’s speech and what it signals about rates, liquidity, and economic outlook beyond 2025.

FOMC Rate Cut Decision: Already Priced In

Bitcoin and equities have rallied over the past two days, leading many to believe the expected 25 bps cut is already reflected in prices.As analyst Michaël van de Poppe noted, when a rate cut is fully expected, it rarely becomes a bullish catalyst on its own. If Powell delivers no surprises, markets could even see a “sell the news” reaction.

Powell Speech Today and the Dot Plot Are the Real Triggers

What matters most in this FOMC meeting are three factors that will shape market direction into 2026:

- 2026 dot plot: The Fed’s median rate outlook for future years

- Powell’s tone: Dovish (supportive of easing) or hawkish (cautious on cuts)

- Dissenting votes: Signs of disagreement within the Fed

Together, these signals will determine how much liquidity markets can expect next year and beyond, a key driver for crypto prices.

- Also Read :

- How High Can Bitcoin Price Go After FOMC Meeting Today?

- ,

FOMC Meeting Uncertainty Grows as CPI Data Goes Missing

This meeting comes with added uncertainty. Due to the government shutdown, two months of CPI inflation data are unavailable, leaving the Fed without a full picture of recent inflation trends.

This uncertainty increases the chances of higher volatility, especially if Powell emphasizes caution or data dependency.

Bitcoin’s technical structure also adds risk. BTC is currently showing a negative correlation with stocks, meaning:

- When equities rise, Bitcoin reacts weakly

- When equities fall, Bitcoin drops harder

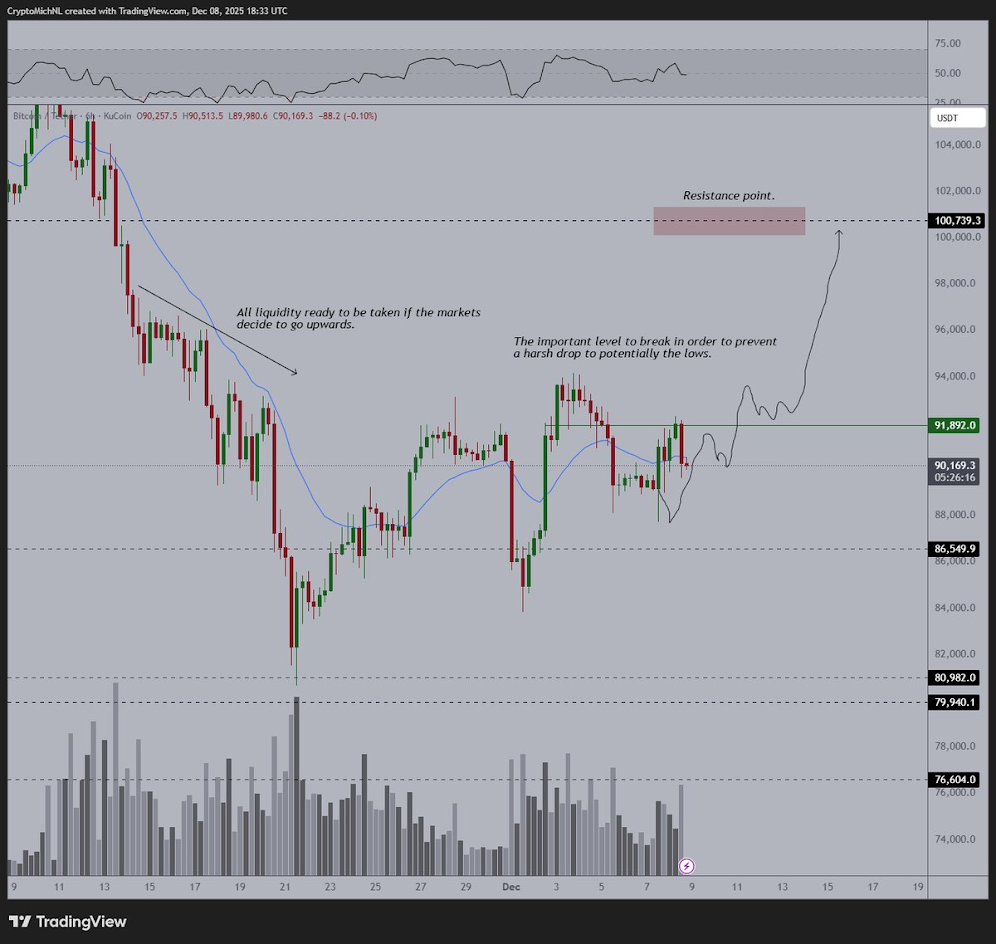

Van de Poppe highlights $92,000 as a critical resistance level. A rejection here increases the chances of a deeper correction.

If Powell remains hawkish and questions future rate cuts, Bitcoin could see a sharp pullback toward the $78,000–$82,000 range, before a possible quick reversal. A clearly dovish signal, however, could keep the breakout scenario alive.

Two Clear FOMC Decisions on the Crypto Market

- Fed cuts rates

- Powell hints at liquidity support

- Labor market weakness is acknowledged

Bearish Scenario

- Fed cuts rates but signals uncertainty

- No mention of bond buying or liquidity tools

- Inflation concerns dominate the message

A repeat of December 2024’s hawkish tone could turn any Santa rally into a Santa dump, similar to how altcoins fell 60–80% after that meeting.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

2 months ago

9009

2 months ago

9009

English (US)

English (US)