A Polymarket trader has seen their stake across various bets lose more than $2.36 million in just eight days.

The account, which joined the platform in January 2026, shows a total of 53 predictions placed over the short period, ending with an all-time loss of approximately $2.36 million and a remaining position value close to zero, according to insights retrieved from Polymarket on January 13.

Crypto trader’s bets summary. Source: Polymarket

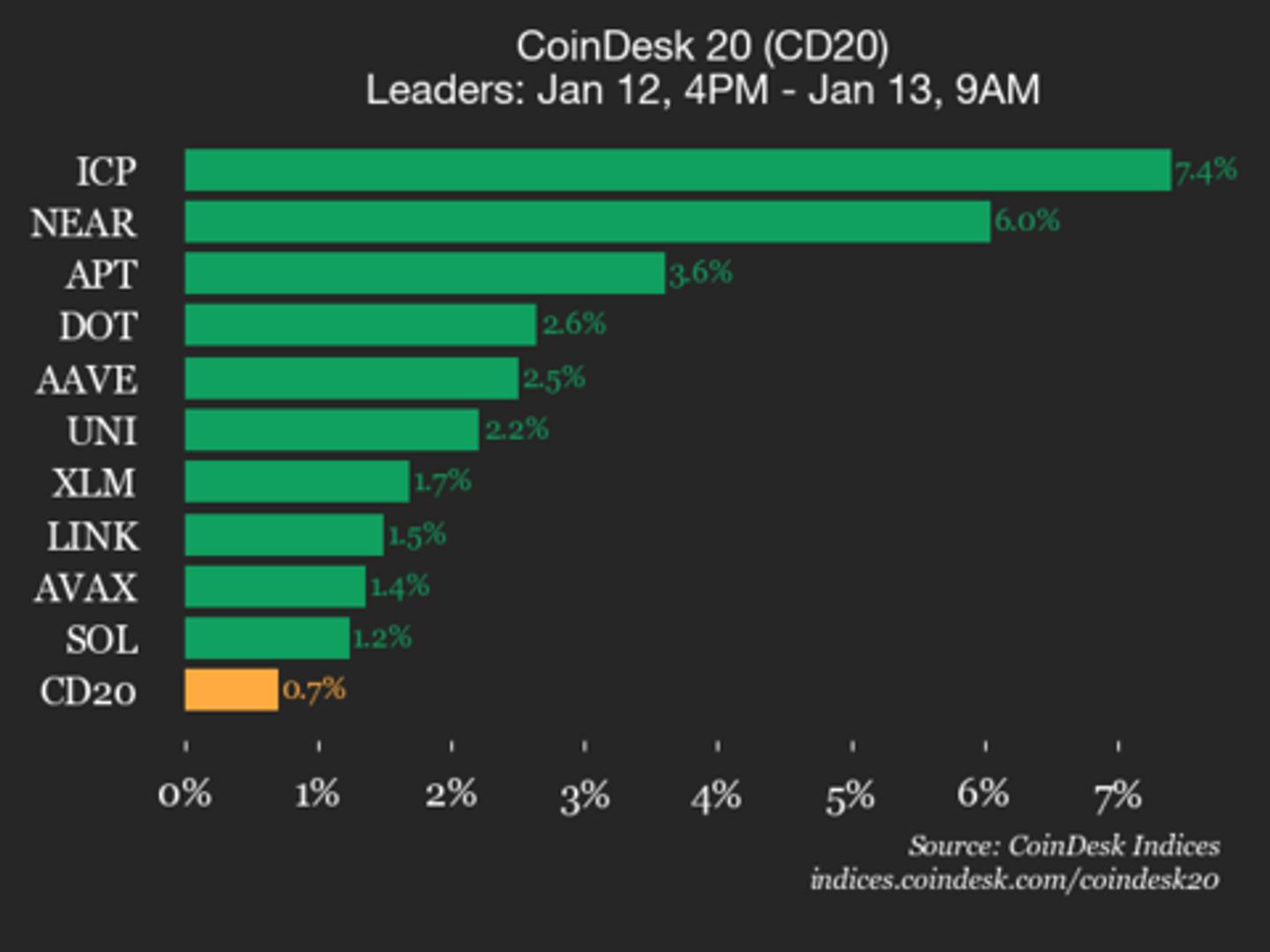

Crypto trader’s bets summary. Source: Polymarket During the eight days, the trader recorded 25 winning trades and 28 losing trades, resulting in a win rate of about 47.2%. On the surface, the performance was not dramatically poor, but the structure of the bets proved fatal.

The activity was heavily concentrated in sports markets, particularly NFL, NBA, NHL, and NCAA games, with a strong preference for spread-based outcomes rather than simple win-or-lose markets.

How the trader lost

Most positions were entered at prices between $0.40 and $0.60, implying moderate confidence rather than near certainty.

Crypto trader’s bets summary. Source: Polymarket

Crypto trader’s bets summary. Source: Polymarket However, conviction was expressed through size rather than pricing. Individual trades frequently ranged from $200,000 to more than $1 million, with some positions exceeding two million shares. These bets were typically held through settlement, with no evidence of hedging, scaling out, or reducing exposure as outcomes approached resolution.

Interestingly, the trader did record several notable wins. Some successful positions delivered returns of roughly 60% to 150%, generating individual profits in the hundreds of thousands of dollars and, in one case, producing a single win of more than $700,000.

These gains, however, masked a deeper structural problem. Losing trades in Polymarket spread markets often settle at zero, resulting in a total loss of the capital committed to that position.

As a result, just two or three losing outcomes were enough to erase the profits from multiple winning bets. With no apparent limits on position size and little diversification across correlated outcomes, the account’s equity became dependent on the results of a handful of games.

Ultimately, the losses stemmed from allowing single outcomes to determine the survival of the entire account.

Featured image via Shutterstock

The post How this crypto trader blew over 2 million in 8 days on Polymarket appeared first on Finbold.

2 hours ago

332

2 hours ago

332

English (US)

English (US)