Ripple’s first major XRP escrow unlock on January 1, 2018, marked a defining moment for the token’s market structure, introducing a predictable supply-release mechanism that has remained in place for years.

At the time of that initial unlock, XRP was trading at approximately $2.20 during the peak of the broader cryptocurrency bull market.

Now, an investor who allocated $100 to XRP on that date would have purchased about 45.45 XRP.

As of press time on January 4, with XRP trading at $2.09, that holding would be valued at roughly $94.55, representing a decline of about 5.5% over seven years.

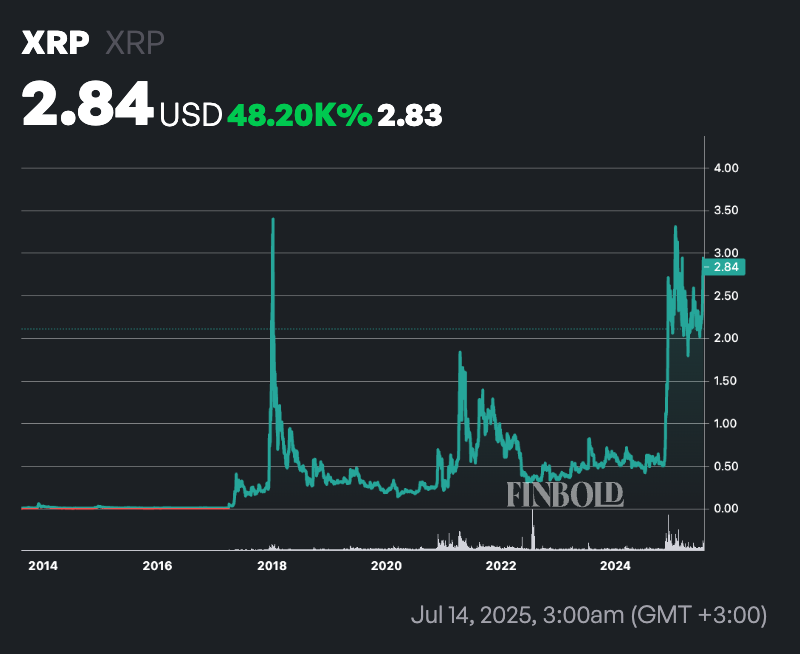

XRP all-time price chart. Source: Finbold

XRP all-time price chart. Source: FinboldRipple unlock mechanism

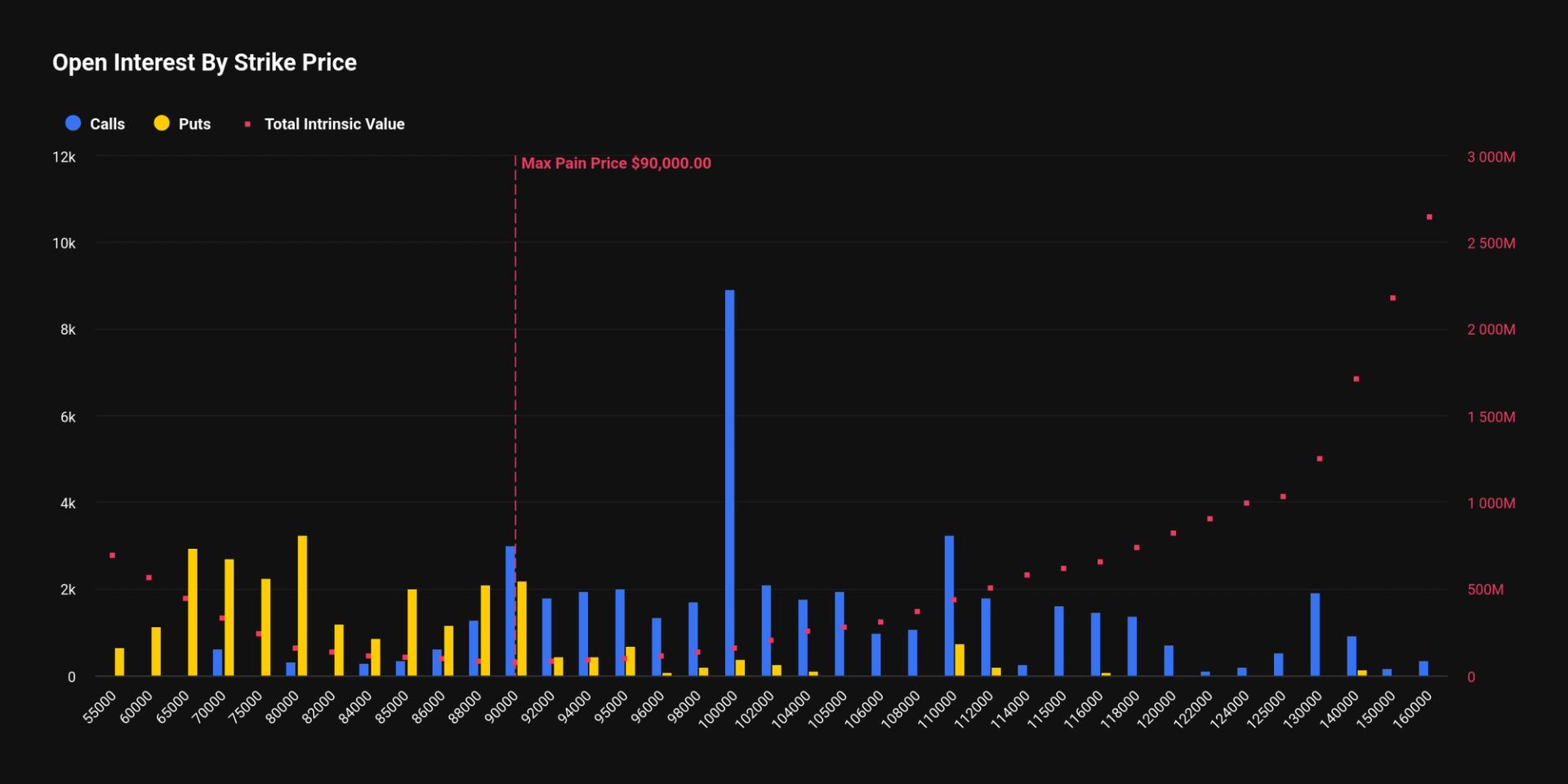

Notably, Ripple introduced its escrow mechanism in late 2017, locking 55 billion XRP into time-based contracts to manage supply. Up to 1 billion XRP is unlocked monthly, with much of it typically re-escrowed, aiming to provide a predictable supply and support liquidity.

While this structure has improved transparency and reduced fears of sudden releases, it has also fueled ongoing concerns about supply pressure and long-term valuation.

Since 2018, XRP’s price has been shaped by both macro and asset-specific factors, including the post-2018 crypto bear market, shifting risk appetite, and regulatory pressure stemming from Ripple’s long-running case with the US SEC.

Broader market cycles, rising competition in blockchain payments, and adoption trends for Ripple’s cross-border products have also influenced performance.

Despite sharp rallies and deep pullbacks over the years, XRP now trades slightly below its level at the first escrow unlock, leaving early long-term investors with modest nominal losses.

XRP price analysis

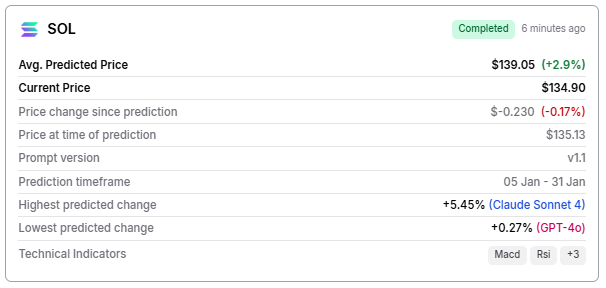

As things stand, XRP is trading around $2.09, sitting just above its 50-day simple moving average (SMA) at $2.04, suggesting short-term price action remains relatively stable and mildly supportive.

However, the token remains well below its 200-day SMA near $2.46, highlighting a broader bearish trend and indicating that longer-term momentum has yet to turn decisively positive. This gap between the short- and long-term averages underscores ongoing downside pressure despite recent consolidation.

Meanwhile, the 14-day RSI stands at around 57, placing XRP firmly in neutral territory. This suggests neither overbought nor oversold conditions, with momentum modestly tilted to the upside but lacking strong conviction.

Featured image via Shutterstock

The post If you invested $100 in XRP after Ripple’s first token unlock; Here’s your return now appeared first on Finbold.

21 hours ago

1844

21 hours ago

1844

English (US)

English (US)