The much-anticipated year-end boost for Bitcoin and Ethereum did not materialize this December, as both cryptocurrencies wrapped up the fourth quarter with significant declines. Traditionally known as the “Christmas rally,” this period saw diminished market activity and decreased risk enthusiasm, further pressuring prices. Bitcoin’s effort to surpass critical levels was thwarted by sell-offs, while Ethereum and other major altcoins followed suit, signaling a market inclined toward risk-aversion as the year drew to a close.

Did Holiday Trends Succeed?

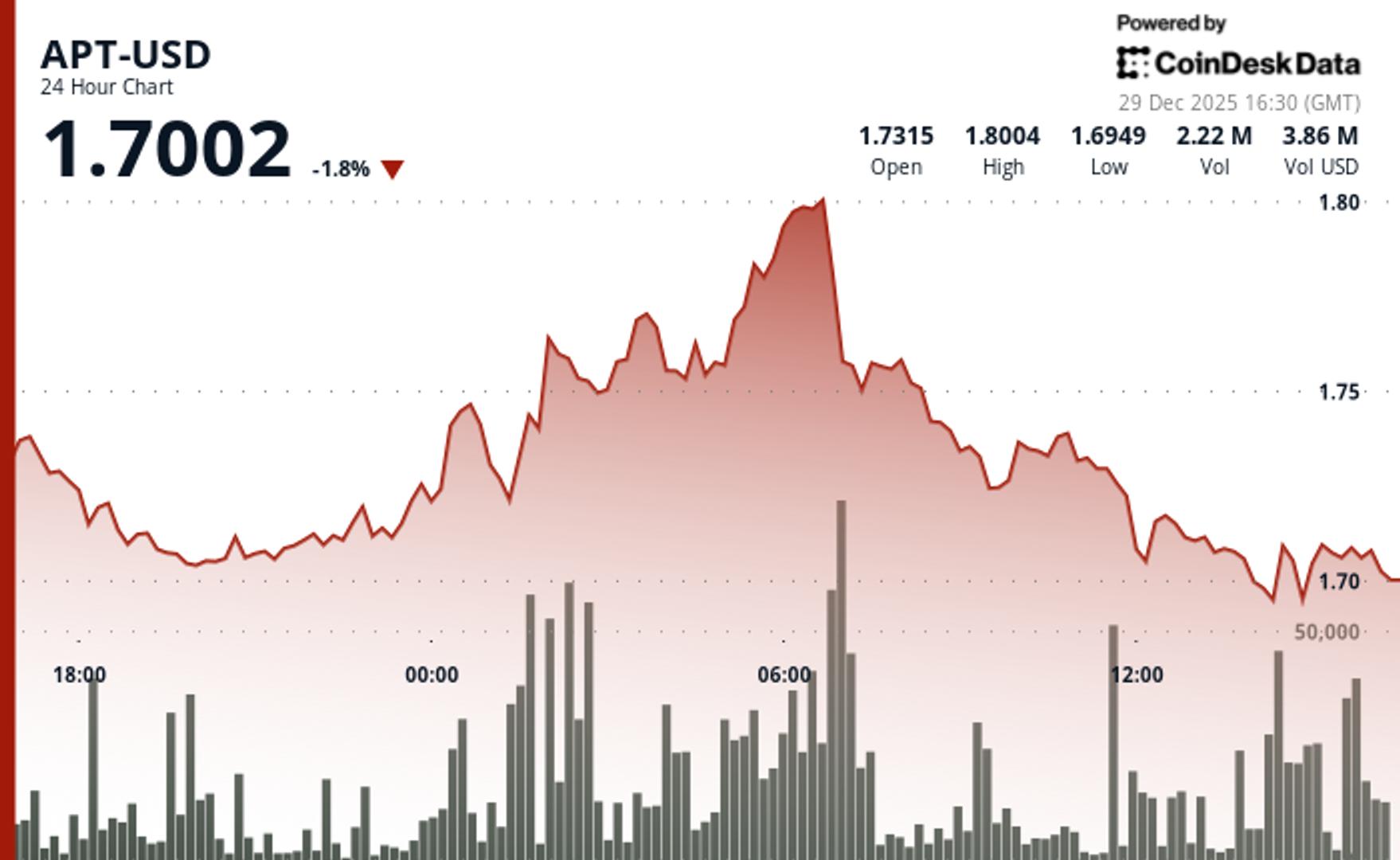

Bitcoin faces an approximate December decline of 22%, marking it as the weakest for the month since 2018. Ethereum’s situation appears gloomier, with a staggering 28.07% loss for the fourth quarter, as noted by CoinGlass, a vital data source for market enthusiasts. This seasonal trend generally marks a liquidity-driven rally during the final week of the year extending into January, yet this year, it fizzled out.

As the holidays neared, cryptocurrencies endured leverage curtailments and brisk profit-taking actions. This downturn highlighted crypto’s dependence on year-end patterns, traditionally providing a bounce into the new year. This quarter, however, seems more like a strategic retreat, as cautious behavior overwhelmed eagerness to engage in risk.

Unlike cryptocurrencies, precious metals had a notable rally, accentuating the divergence. Gold achieved new record highs owing to interest rate cut predictions and ongoing geopolitical strain. Silver and platinum saw substantial upward movement too.

Central banks’ sustained buying activity and escalated ETF demand boosted gold’s uptrend. In uncertain periods, investors leaned towards stable assets, favoring metals over digital currencies, which failed to emerge as a perceived safe haven.

With macroeconomic easing signs emerging, Bitcoin struggled to uphold momentum without significant risk appetite. Fluctuating bond yields and volatile dollar shifts fostered a defensive investment stance, with end-of-year trading, particularly in the U.S., hinting at fund managers closing positions. The upcoming year’s initial test will be whether Bitcoin retains its supportive barriers.

Among the critical observations are:

- Bitcoin’s December losses nearing 22%.

- Ethereum recording over a 28% quarterly drop.

- Precious metals outshine with gold reaching record levels.

- Investor caution prevails over risk-taking as the year ends.

With eyes set on the first quarter of the new year, the cryptocurrency market awaits signs of rebounding momentum. The key question remains whether the current cautious climate will shift to allow for a robust recovery, or if the risk-averse sentiment will persist further into the new fiscal calendar.

Disclaimer: The information contained in this article does not constitute investment advice. Investors should be aware that cryptocurrencies carry high volatility and therefore risk, and should conduct their own research.

English (US)

English (US)