The post MYX Price Crashes 80% After $6.94 Peak: Is It Brutal Flush or Ultimate Reset? appeared first on Coinpedia Fintech News

What was witnessed in the MYX price isn’t just a dip. It collapsed severely. From an early February high of $6.94, the token has dumped over 80%, even slicing through a long-term ascending trendline that had been intact for months. This breach was the most unexpected, but it still occurred and even lost the crucial $1 support level from September 2024. Now, MYX/USD trades at $0.8762, shrinking its market cap to just $221.75 million, but questions about this dip are rising: Is it over for MYX, or was it a big player’s strategic move?

Is MYX Price Just Witnessing a Liquidity Grab or Is It an Ordinary Collapse?

An analyst on X called it weeks ago, describing whales as “liquidity grabbers” and refusing to chase what he viewed as a fake trend, that was keeping the price floated above $6. Looking at the MYX price chart now, it’s hard to argue that something this aggressive happened.

The breakdown below multi-month trendline support and the psychological $1 level wasn’t subtle. It wiped out leveraged longs. It crushed late buyers. It filtered weak hands fast.

But here’s the thing, the big destruction usually comes with silence.

MYX Exchange Activity Still Rising: What It Means for Its Token?

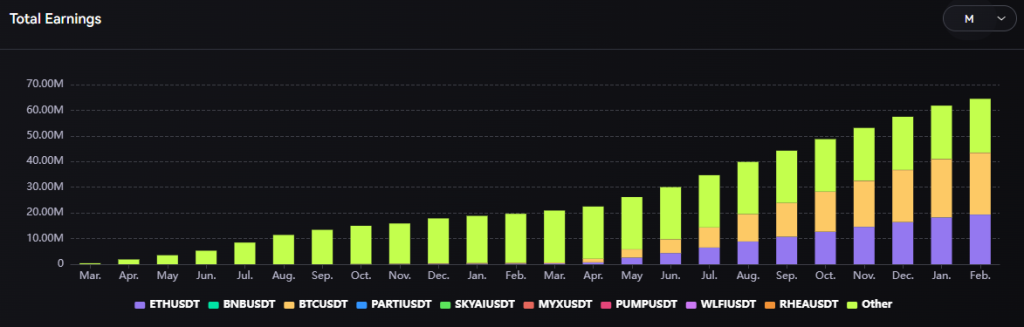

Despite the collapse, MYX exchange activity remains strong. The platform reportedly holds 178K users, and total earnings by mid-February climbed to $64.45 million, up from January’s $61.79 million. That’s not the profile of a ghost chain.

Revenue is increasing. Participation remains measurable. That doesn’t automatically translate into price strength, but it certainly challenges the “dead project” narrative.

So, what gives? Well, one interpretation is that the recent move was designed to flush excessive optimism and reset positioning. A classic overheat-and-cool cycle. And technically, the MYX price is now sitting in a key demand area after the vertical drop.

MVRV Reset: Hidden Bull Signal?

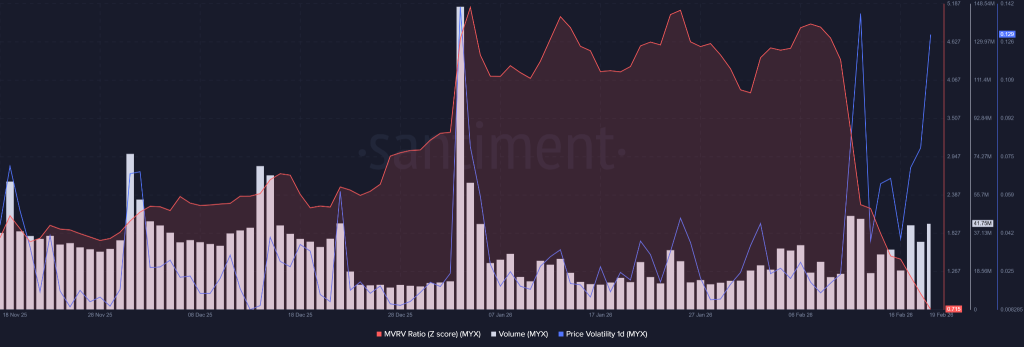

Here’s where it gets even more interesting. The collapse triggered a significant MVRV Z-Score reset. Previously, the asset had entered overvaluation territory. That imbalance between market value and holder cost basis has now been dramatically reduced.

In simple terms? The speculative froth has been cleared.

Historically, such resets can create healthier foundations for organic recovery only if demand stabilizes and accumulation begins. But, this doesn’t guarantee reversal, but it shifts the MYX price prediction narrative away from euphoria and toward valuation reset.

So, is it worth buying this dip? That depends on whether current demand holds and long-term participants step in. The MVRV structure suggests the excess has been wrung out. The platform metrics suggest it’s operationally alive. The chart suggests capitulation has already happened.

For now, the MYX price analysis shows that token sits at a crossroads technically wounded, structurally reset, and waiting for accumulation to either confirm recovery… or not.

2 hours ago

119

2 hours ago

119

English (US)

English (US)