Reports have disclosed that Polygon closed the final quarter of 2025 with higher on-chain usage, driven by payments, stablecoin transfers, and tokenized assets.

While traders watched MATIC drift inside a narrow range, activity on the chain told a different story, one focused on payments, stablecoins, and quiet institutional adoption rather than price momentum.

Polygon Payments Use Grows Faster Than Prices

According to Messari’s Q4 network review released on January 4, Polygon processed heavy payment traffic as fees stayed low and settlement times remained short. More than 50 apps built for payments handled about $3.50 billion in transfers during the quarter.

That figure was 96% higher than the prior quarter and close to four times the level seen a year earlier. Stablecoin-linked cards added another layer of activity.

Ten card programs together moved nearly $363 million using Mastercard and Visa rails, with Visa responsible for the larger share. Reports say this growth came from everyday spending rather than one-off events, a sign that Polygon is being used for routine transfers instead of short-term experiments.

Beyond card payments, several firms expanded how they move money on the chain. DeCard allowed users to pay with USDC and USDT at a wide range of merchants.

Flutterwave chose Polygon for cross-border business payments in 30 African countries. Revolut integrated cheap stablecoin transfers inside its app, while Stripe continued building subscription tools that rely on USDC.

None of those moves grabbed market headlines, yet together they pushed steady volume through the network.

Tokenized Assets Gain Ground Quietly

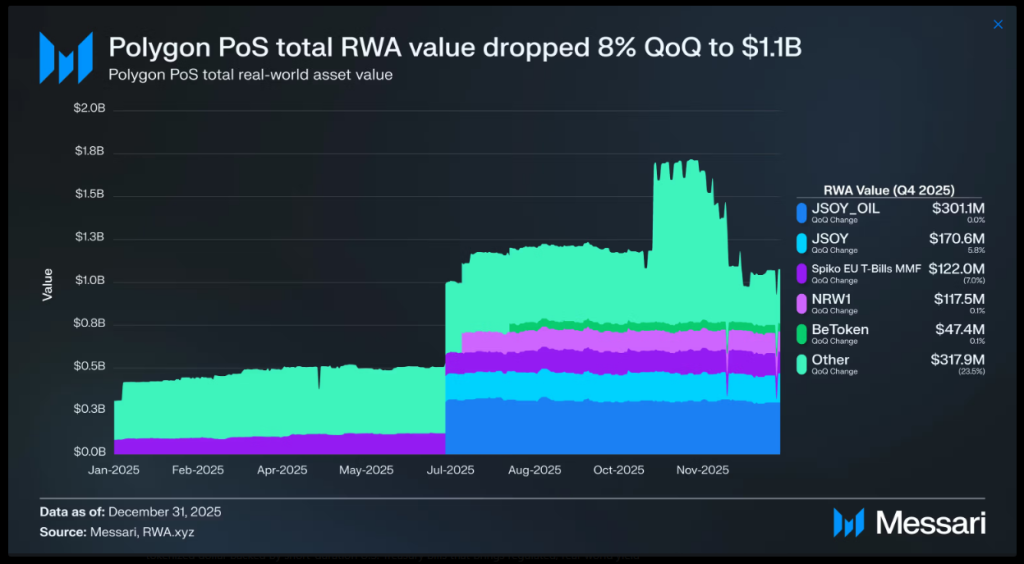

Away from payments, tokenized real-world assets continued to stack up. Reports note Polygon ended Q4 with nearly $1.10 billion in RWAs, ranking ninth worldwide. Growth was driven less by retail hype and more by regulated structures.

Stablecoin supply climbed to nearly 3 billion, led by USDC at $1.34 billion and DAI near $630 million. Latin America stood out as a key region, where non-USD stablecoin volume totaled $1.18 billion. Average daily DEX volume jumped 44% to a little over $200 million.

MATIC’s price action stayed restrained despite the on-chain growth. The token slipped back from short-term resistance during broader market weakness and then stabilized as buyers defended key support zones.

Deeper losses were avoided, but strong upside moves failed to appear. Volume has yet to confirm a shift in trend. For now, Polygon shows rising use across payments and tokenized assets, while its token waits for a clearer signal from traders.

Featured image from Unsplash, chart from TradingView

1 hour ago

445

1 hour ago

445

English (US)

English (US)