The post XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds appeared first on Coinpedia Fintech News

The year 2025 has recently closed, and the XRP price prediction January 2026 is already in focus, as this blue-chip asset has become fundamentally very strong with time.

As a result, it’s drawing immense attention, and its on-chain data points clearly reflect that, even hinting at a structural change beneath muted price action.

While XRP price today remains range-bound, whale accumulation, ETF inflows, and derivatives positioning suggest that the market may be transitioning from distribution into a prolonged compression phase with an upward bias.

Whale Accumulation Reshapes XRP Price Structure

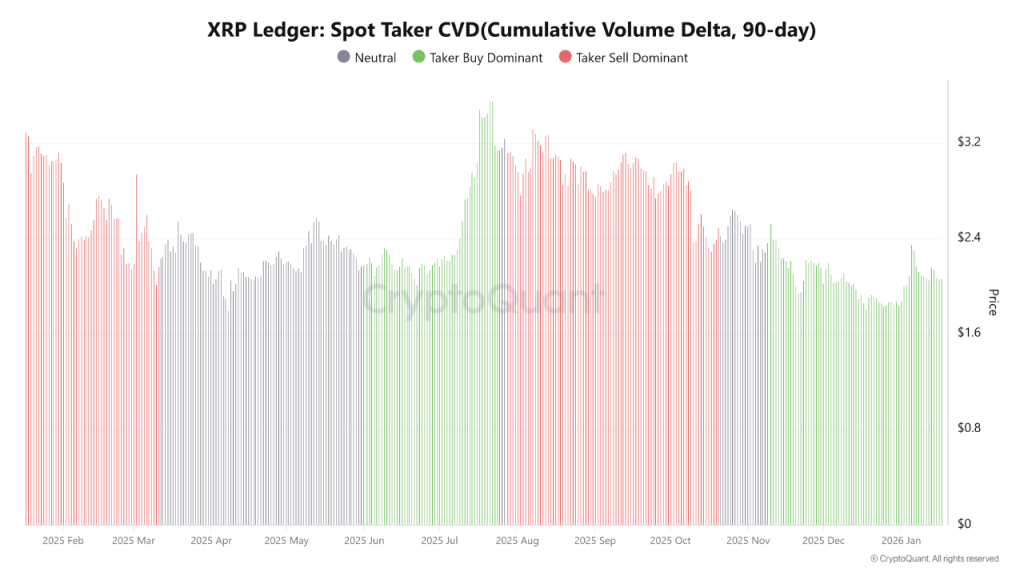

On the daily technical chart, despite the XRP price chart facing resistance near its 200-day EMA, on-chain indicators suggest growing structural strength. Over the past 90 days, XRP/USD has remained in a taker buy dominant phase, meaning market buy orders have consistently outweighed sell orders. This prolonged imbalance highlights steady absorption of supply rather than speculative spikes.

The 90-day Cumulative Volume Delta (CVD) turning positive and trending higher reflects conviction-driven accumulation. Historically, such sustained CVD expansion often precedes volatility expansion, particularly after extended consolidation phases.

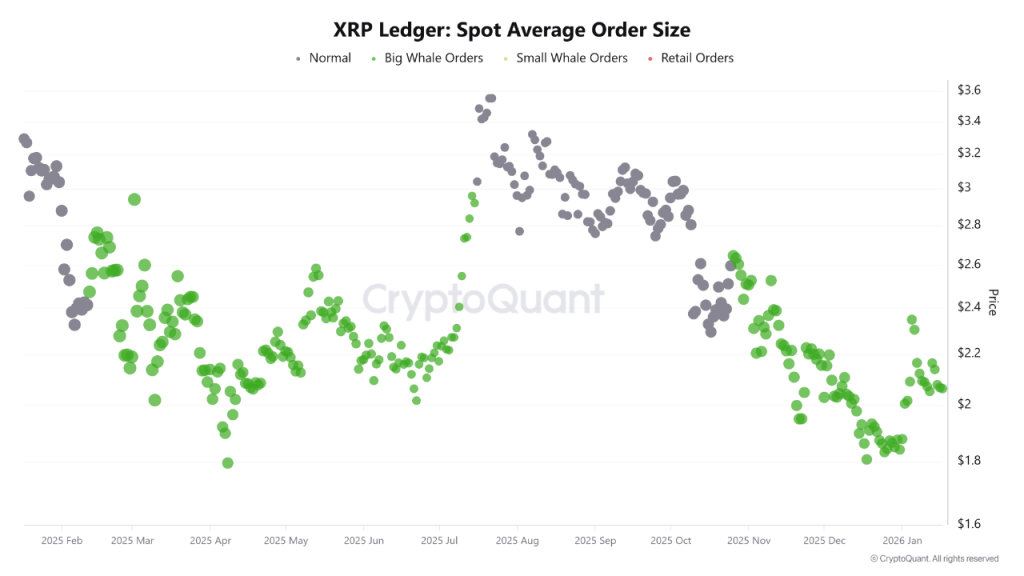

Large Order Flow Signals Institutional Positioning

Alongside rising buy pressure, average spot order size data points to increasing dominance of larger trades. Frequent signals associated with higher-volume orders imply that whale participation is intensifying.

At the same time, ETF-related flows have added to this narrative. Since November, XRP ETF accumulation has been heavily one-sided, with inflows vastly outweighing outflows. Such behavior typically reflects long-term allocation strategies rather than short-term speculation, tightening circulating supply and reinforcing the longer-term XRP price forecast narratives.

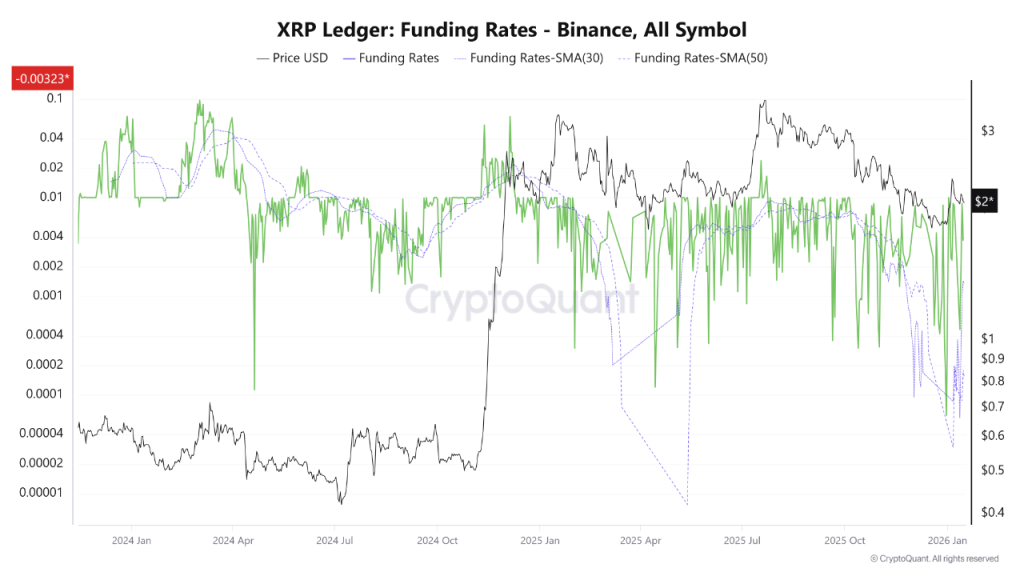

Funding Rates Suggest Asymmetric Risk

While spot accumulation remains strong, derivatives data paints a complementary picture, too. Current funding rates remain negative, with short positioning dominating leveraged markets. Historically, such conditions showcase the recent pessimistic sentiment rather than overall euphoria.

Moreover, the negative funding environments have often coincided with local bottoms, because excessive short exposure reduces the likelihood of aggressive downside continuation.

That said, if funding rates gradually normalize or start to flip on the positive side, then XRP price action has a history of reacting towards the upside direction following periods of compression.

Technical Compression Builds for Expansion

From a technical perspective, the XRP price chart behavior shows a tightening range between $2.00 – $2.40. The recent rejection from the 200-day EMA confirms this range.

But given XRP’s sentiment and price action, the 200-day EMA band remains a short-term constraint, while on-chain data paints a bullish picture.

Now, if it flips $2.40 again, then it will aim for $2.75 and $3.00 targets, respectively. Failure to hold $2.00 would invalidate the bullish setup.

2 hours ago

631

2 hours ago

631

English (US)

English (US)