XRP has erased more than $11 billion in market value over the past 24 hours amid intensifying selling pressure across the broader cryptocurrency market.

In this regard, the token’s market capitalization dropped from $101 billion to $89.31 billion at press time, marking a sharp $11.6 billion contraction in a single day.

XRP 24-hour market cap chart. Source: CoinMarketCap

XRP 24-hour market cap chart. Source: CoinMarketCapOver the same period, XRP fell nearly 10% to trade around $1.46, extending its short-term decline after a recent attempt to move above $1.50. The pullback comes as a notable technical warning signal emerges on the daily chart.

This decline fits within broader cryptocurrency market weakness, where Bitcoin (BTC) has failed to hold above the $70,000 level. The latest downturn has been driven by anticipation of key macroeconomic data, including Federal Reserve minutes and inflation reports.

Meanwhile, the main catalyst for XRP’s sharper drop appears to be a massive sell-off on the South Korean exchange Upbit, where approximately $50 million worth of XRP was offloaded.

This triggered heavy selling pressure, halted a recent rebound attempt, and pushed the price to a two-day low near $1.46.

Data indicates that most of the activity reflected genuine sales rather than wash trading. XRP had been attempting a recovery earlier in the week, rising from February lows and briefly surging 11–20% in prior sessions amid signs of accumulation, such as reduced Binance reserves.

XRP’s woprrying technical outlook

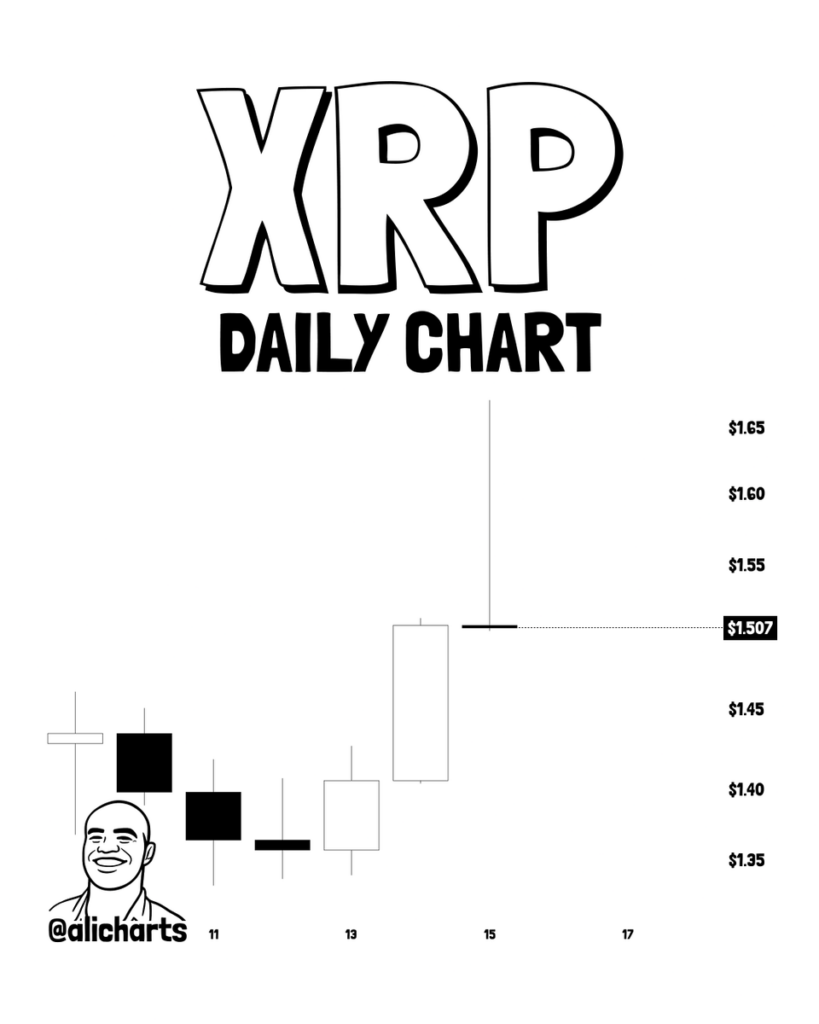

From a technical analysis perspective, there are concerns that the asset might see further losses. Analysis shared by Ali Martinez in an X post on February 5 pointed to the formation of a gravestone doji near the $1.50 level.

XRP price analysis chart. Source: Ali Martinez

XRP price analysis chart. Source: Ali MartinezThis candlestick pattern forms when price rallies strongly during a session but then reverses and closes near its opening level, leaving a long upper wick. Technically, it often signals bullish exhaustion, meaning buying momentum may be fading as sellers begin to regain control.

When such a pattern appears after an upward move, it can indicate an increased risk of a short-term reversal, particularly if followed by continued downside in subsequent sessions.

With XRP now trading around $1.46, the $1.50 zone may act as near-term resistance, while the $1.40 area stands out as immediate support.

A sustained break below support could open the door to further losses, whereas a decisive move back above recent highs would be needed to invalidate the bearish signal and restore bullish momentum.

Featured image via Shutterstock

The post XRP wipes out over $11 billion in a day as major crash signal pops appeared first on Finbold.

2 hours ago

177

2 hours ago

177

English (US)

English (US)